Brand Finance has ranked Equity Group as the second strongest banking brand globally and the first in Africa by achieving high rankings in its 2024 Brand Strength and Brand Value assessments.

Equity Group ascended from 4th to 2nd position in the World’s Top 10 Strongest Banking Brands with a brand strength index score of 92.5 out of 100, earning an elite AAA+ brand strength rating, marking a 0.1 point BSI improvement on its 2023 ranking in its third consecutive appearance in the Banking 500 rankings.

Further, Equity’s brand value increased by $22 million, reaching $450 million, securing it the tenth position in Africa.

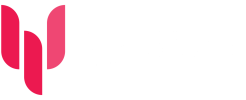

Equity’s Managing Director and CEO, James Mwangi, attributes the success to strong governance, customer-centric practices, and a commitment to innovation.

“As we continue to anchor our business on our purpose and support the day-to-day lives of our customers, it fuels our commitment to innovation and excellence, driving us to redefine standards and pioneer transformative solutions in the financial industry.”

Did you read this?

Brand Finance assesses 5,000 major brands each year and releases about 100 reports, ranking brands worldwide across various sectors.

The annual Brand Finance Banking 500 ranking features the world’s top 500 most valuable and strongest banking brands.

While trust remains crucial in customer decision-making for banking services, Brand Finance’s research highlights the significance of articulating a sense of purpose and effectively meeting customer needs.

The Brand Finance Banking 500 report is the industry’s foremost authority. It evaluates financial institutions’ brand value using quantitative and qualitative metrics such as brand strength, loyalty rate, and revenue forecasts.

Brand Finance’s CEO David Haigh says the dominance of China’s mega-banks in brand value while highlighting the increasing strength of local banks.

“As the world’s top banking brands reach new heights, China’s mega-banks continue to dominate at the top of the brand value ranking. Another key insight from our 2024 data is that local banks increasingly outshine their larger counterparts in brand strength,” Haigh said.

“Dominant brands thrive in singular markets with limited competition, while banks expanding into multiple markets may successfully augment their brand value but risk diluting brand strength.”